It can be hard enough to manage your finances when your circumstances are relatively simple, let alone when you have extra challenges due to your career. When you need help, how do you know who to turn to? Who can you rely on to understand your life and guide you through complicated decisions and opportunities?

That’s why Envision Wealth Planners exists. We founded our practice to help high-income families and real estate executives and brokers navigate their financial situations with confidence and build a secure financial future. Because of your unique income situation, you might think that a financial plan won’t work for you. But that’s exactly why you do need a plan—one customized to your life, challenges, and opportunities.

What Does a Financial Plan Include?

First, you may be wondering about what goes into a comprehensive plan. Financial plans often address a myriad of concerns and goals, from tax efficiency to retirement income strategizing. Depending on your needs, your plan may narrow in on one element or address multiple goals you’d like to achieve over time. Whatever you choose to focus on, your financial plan is designed to serve as your road map, helping you navigate the years before, during, and after your transition to retirement.

We believe a good financial plan should give you a detailed, complete view of your current financial situation, a thorough modeling of where you want to be, and the actions you need to take to reach those goals. It should address all the pieces of your financial puzzle, from stresses and fears to your values and dreams, and include cash flow, retirement, estate planning, taxes, education, and income strategies to help bring you clarity and guidance. It is through our planning process that we can help you prepare for life’s expected and unexpected circumstances and show you your options for when you can slow down and live the retirement you imagine. The result is a simple yet powerful road map to guide your decisions.

See a Sample Financial Plan

Here is a sample financial plan that reflects our planning process. It looks at a fictional client’s lifestyle income plan and how we developed it, including identifying their goals, creating a balance sheet, reviewing their cash flow, and more.

Keep in mind that this is only a hypothetical plan presented to illustrate what a client’s plan may resemble should they work with me. The characters and circumstances are completely fictional and are for illustrative purposes only. Be sure to seek the advice of a qualified professional for your particular situation and not rely upon any of the information herein to make personal financial decisions.

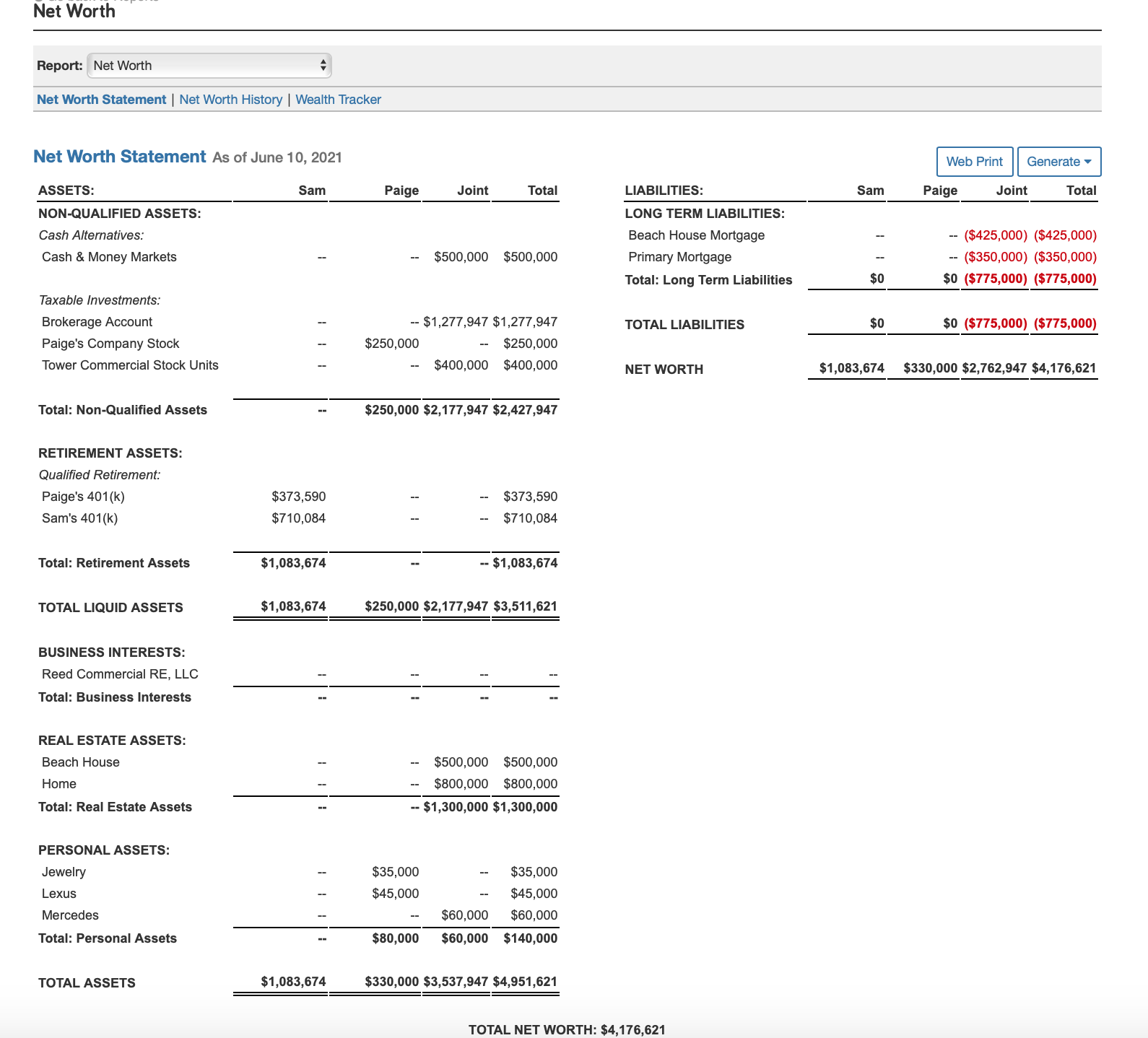

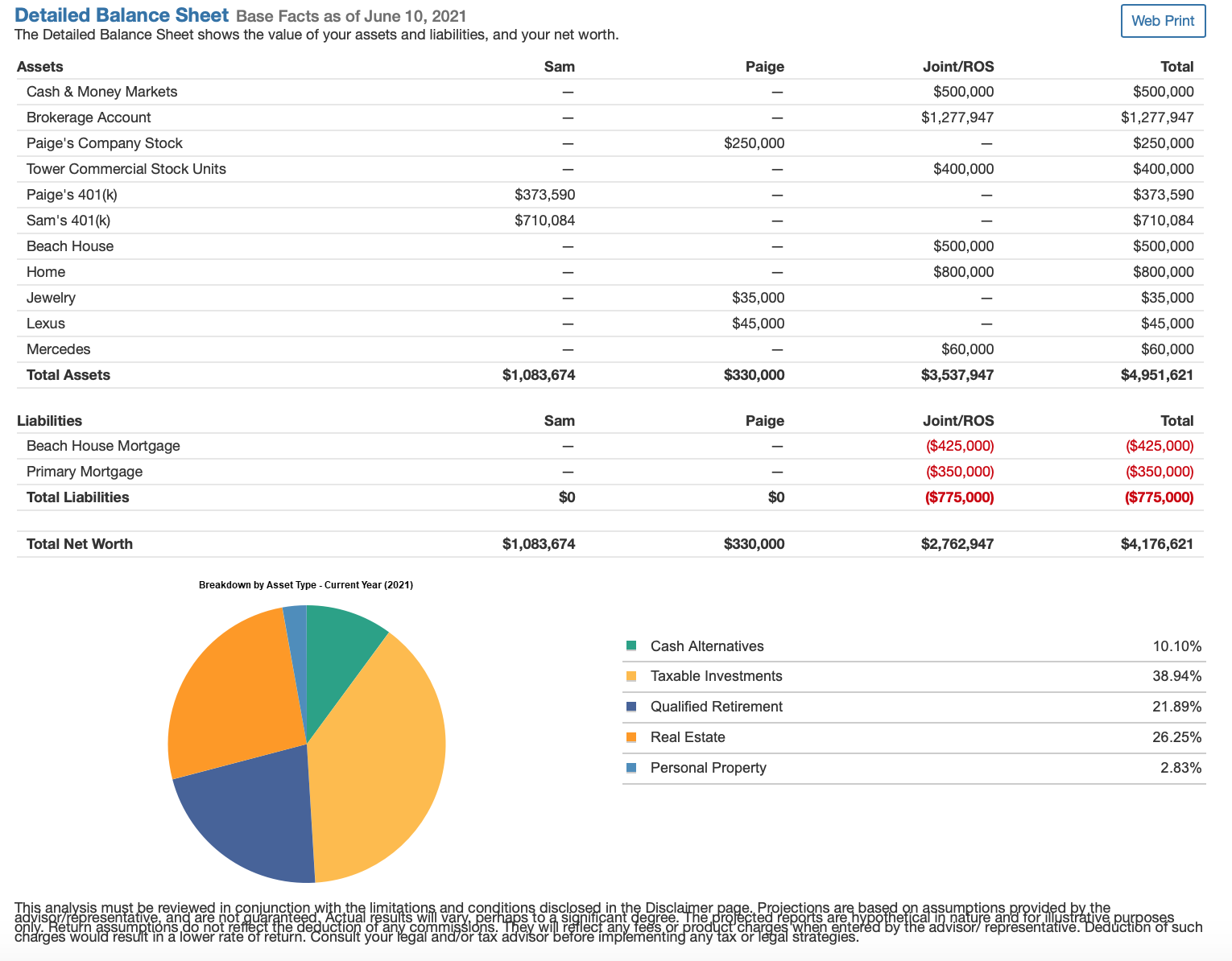

We provide an overview of your current situation. With just one glance, you can see a big picture of your financial life, including assets broken down into specific categories and short-term and long-term liabilities. We also include a detailed breakdown of all your financial resources.

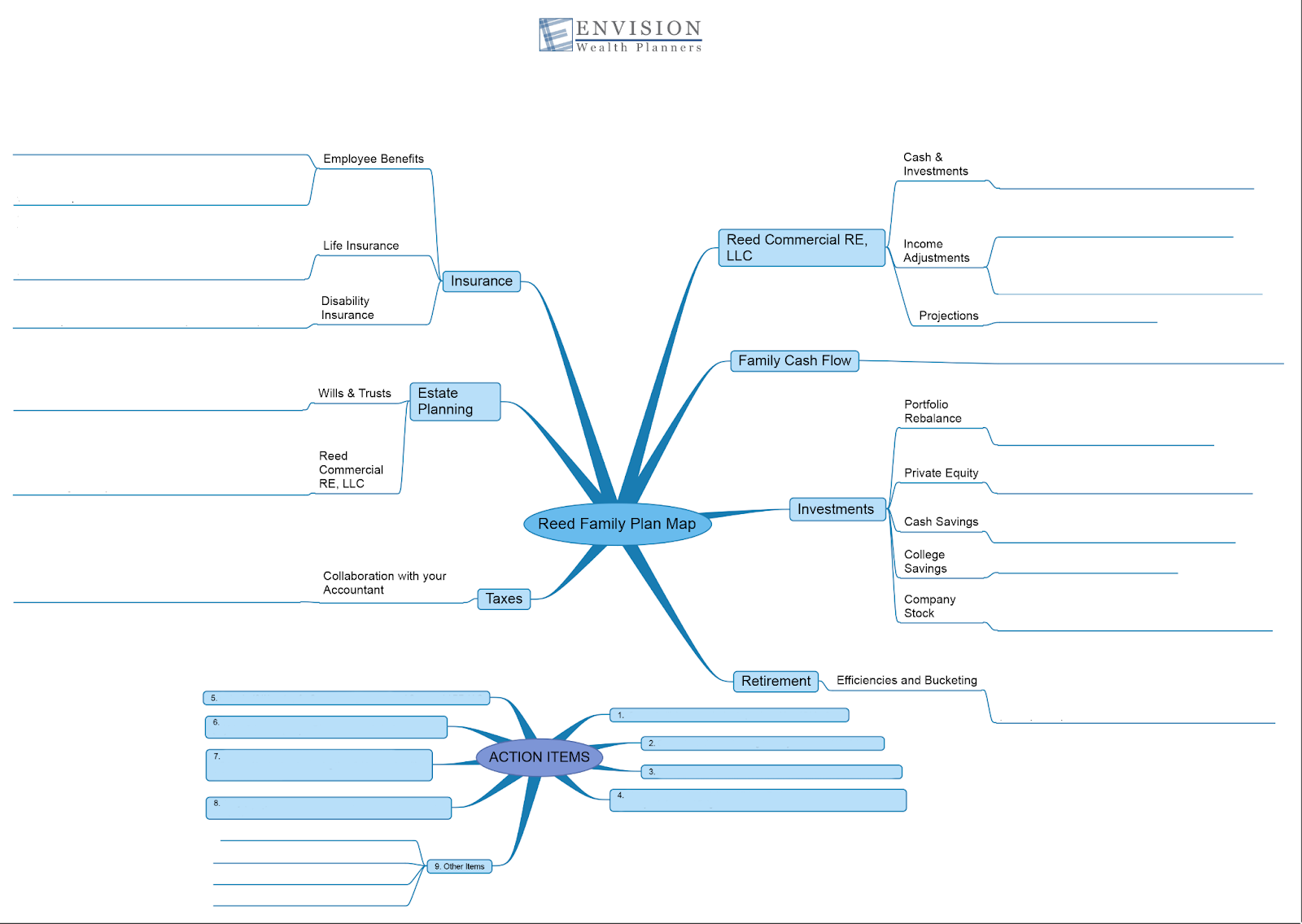

With your entire financial picture firmly in place, we then analyze your needs and goals and develop an action plan, leaving no stone unturned. Our Mind Map lays out every aspect of your plan with steps to take, timelines to follow, and questions to answer. For example, when looking at retirement, we’ll discuss how much cash you should have on hand for emergencies and monthly discretionary spending versus how much to keep invested. If you’re wanting to upgrade your home, I’ll recommend how to handle the cash and investment balance to continue growth but also make sure you have what you need for your purchase. I’ll also list out action items based on what we decide, such as connecting with an estate lawyer to secure wills and trusts or using tax-loss harvesting strategies to maximize tax efficiency.

When it comes to your investments, we build investment models by using screening tools that look at a wide range of low-cost investments. This approach will provide you with a diversified portfolio that is built around your long-term goals and values. We also show you a customized cash flow calculation based on your current financial state and estimated retirement age and detailed projections for income, expenses, assets, and mapping your progress toward your goals. We will monitor your plan and make adjustments as necessary to ensure all elements serve your stated goals, values, and lifestyle.

Get Started on Your Plan!

If you want to see even more features of our financial plans, schedule a no-obligation introductory phone call or contact me at connect@envisionplanners.com or 407.720.6535, and together, let’s find out if we’re the right people for you to depend on during your journey to a comfortable retirement.

About Sean

Sean Gerlin is founder, principal, and financial planner at Envision Wealth Planners, an independent financial advisory firm founded on the core values of family, honesty, and a determination to be the master of their trade. With almost 10 years of experience, Sean specializes in serving affluent families and commercial real estate executives and brokers, providing comprehensive, customized financial guidance and services for their complex financial needs. Sean acts as a family CFO, managing and coordinating the many moving pieces of his clients’ financial lives. Sean is known for his commitment to building long-term relationships and paying personal attention to each client. He is passionate about helping his clients experience the relief that comes from having organized and well-planned strategies and portfolios and desires to help them shoulder some of the financial burdens they face.

Sean has a bachelor’s degree from the University of Florida and holds the CERTIFIED FINANCIAL PLANNER™, Chartered Financial Consultant®, and Chartered Life Underwriter® designations. When he’s not working, you can find him cooking, eating good food, traveling, coaching his son’s baseball team, or playing golf. He loves spending time with his wife, Nicole, and their two kids, Avery and Will, and entertaining friends in their beautiful backyard. To learn more about Sean, connect with him on LinkedIn.